Understanding China's Changjing

Explore the latest trends, news, and insights from Changjing, China.

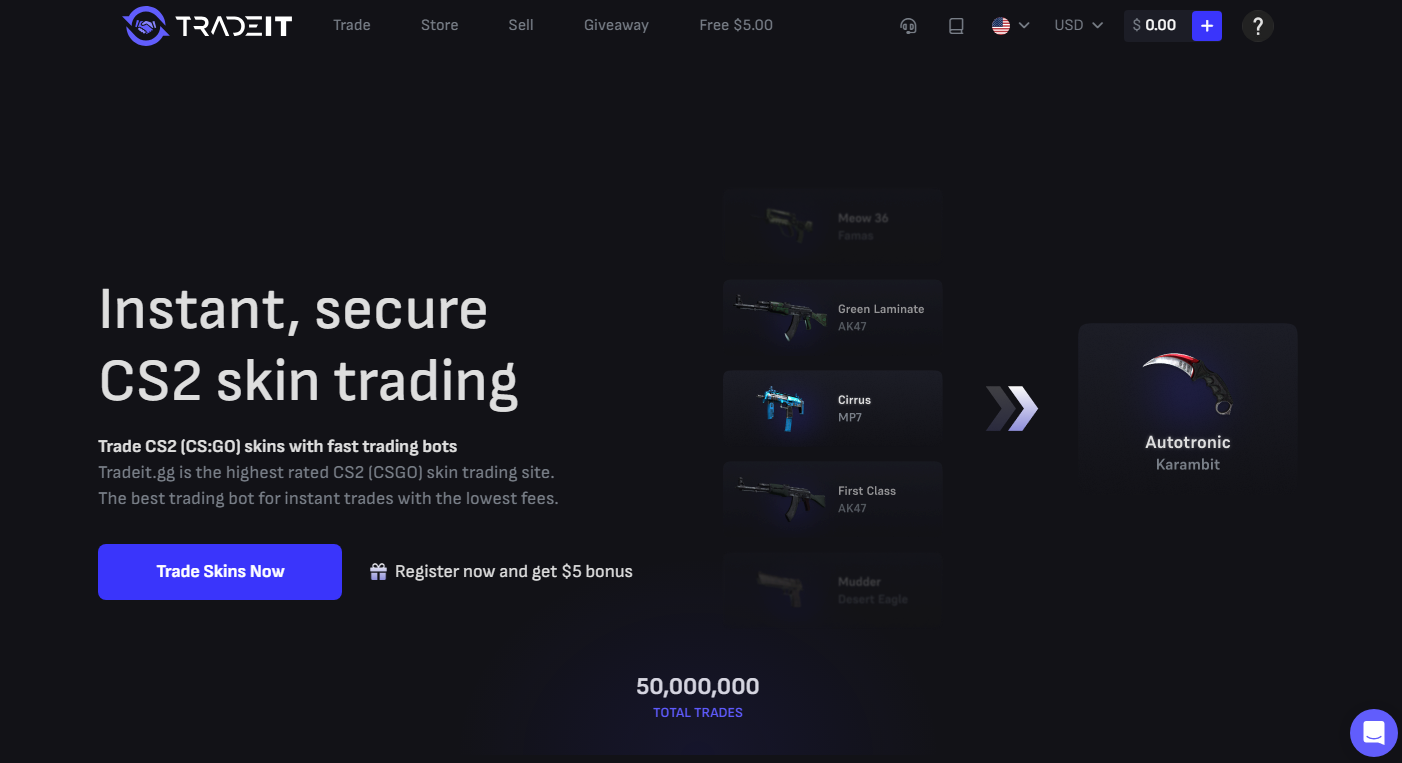

Confessions of a Trade Bot Whisperer

Unearth the secrets of trading bots! Discover expert tips, insider confessions, and strategies to maximize your profits today!

Unlocking the Secrets: How Trade Bots Make Decisions

Trade bots operate using a combination of sophisticated algorithms and data analysis techniques that allow them to make rapid decisions in the financial markets. These automated systems continuously monitor market conditions and analyze various indicators, including price movements, trading volume, and historical data. By leveraging machine learning and artificial intelligence, trade bots can identify patterns and trends that human traders might overlook, thus allowing them to execute trades with precision and speed. This capability is particularly valuable in high-frequency trading, where milliseconds can make a significant difference in profitability.

One of the key components of a successful trade bot is its decision-making process. This typically involves multiple stages:

- Data Collection: The bot gathers relevant market data from various sources.

- Analysis: It analyzes this data using predefined strategies to identify potential trading opportunities.

- Execution: Once a decision is made, the bot executes the trade automatically.

In the ever-evolving world of trading, utilizing advanced technology can make all the difference. For those looking to enhance their trading strategies, my blog titled Trading Secrets with CS2 Trade Bots Revealed! provides invaluable insights into the benefits of automated trading systems and how they can be leveraged for maximum profit.

The Art of Trade Bot Whispering: Tips and Tricks for Success

In the rapidly evolving world of cryptocurrency and stock trading, the concept of trade bot whispering has emerged as a crucial skill for traders seeking to harness the power of automation. Trade bots analyze market trends and execute trades at lightning speed, but they require guidance to optimize their performance. To master this art, start by understanding the unique algorithms of your chosen trade bot. Familiarize yourself with the settings and parameters that allow you to customize its trading strategy. This knowledge equips you to communicate effectively with the bot, ensuring it aligns with your trading goals.

Furthermore, successful trade bot whispering involves continuous monitoring and adjustment of your bot's strategies. Here are some essential tips to enhance your experience:

- Regularly review performance: Analyzing trading results helps identify areas for improvement.

- Stay informed: Keeping abreast of market news can significantly impact trading decisions.

- Test different strategies: Don’t hesitate to experiment with various settings and approaches.

By applying these tips, you can fine-tune your trade bot to react swiftly and intelligently, ultimately leading to increased trading success.

Do Trade Bots Really Understand Market Trends? A Deep Dive

The rise of trade bots has transformed the landscape of trading, leading many to question whether these automated systems can genuinely understand market trends. At their core, trade bots utilize algorithms to analyze market data and execute trades based on predefined criteria. While they can process vast amounts of information at impressive speeds, critics often argue that bot trading lacks the human intuition and emotional intelligence that can be crucial in understanding the nuances of market behavior. Consequently, the question remains: do trade bots merely follow data patterns, or do they possess a deeper understanding of market sentiment?

Despite their limitations, some argue that trade bots can adapt over time through machine learning techniques, potentially allowing them to identify and capitalize on emerging market trends. For instance, advanced algorithms can use historical data to predict future movements, and with continuous updates based on real-time information, they may develop a semblance of predictive capabilities. However, it is essential to recognize that unpredictable market conditions and external factors often lead to unpredictable outcomes. Ultimately, while trade bots represent an innovative approach to trading, their grasp on market trends remains an evolving topic worthy of examination.