Understanding China's Changjing

Explore the latest trends, news, and insights from Changjing, China.

Insurance Showdown: Finding Your Perfect Match

Discover the ultimate guide to choosing the right insurance! Uncover tips, tricks, and insider secrets in our Insurance Showdown. Click now!

Understanding the Different Types of Insurance: Which One is Right for You?

Understanding the different types of insurance is essential for making informed financial decisions. From life insurance to auto insurance, each type serves a specific purpose and provides a unique benefit. Generally, insurance can be categorized into three main types: life insurance, which offers financial support to your loved ones after your passing; health insurance, which covers medical expenses; and property insurance, which protects your personal belongings. Understanding these distinctions can help you choose the right coverage for your situation.

When selecting the right insurance for your needs, it is vital to evaluate your personal circumstances and financial goals. Consider factors such as your age, family situation, and assets. For instance, if you have dependents, life insurance might be the most appropriate choice to secure their financial future. Alternatively, if you own a home, it's important to look into homeowners insurance to protect your property from unexpected events. Make sure to compare different policies and consult experts to find the coverage that best aligns with your requirements.

Insurance Myths Debunked: What You Really Need to Know

When it comes to insurance, many people hold onto common misconceptions that can lead to inadequate coverage or unnecessary expenses. One popular myth is that all insurance policies are the same. In reality, policies can vary significantly depending on the provider and the type of coverage offered. For instance, different car insurance policies can offer varying levels of liability, collision, and comprehensive coverage. It’s essential to understand the specifics of your policy to ensure you're adequately protected.

Another prevalent myth is that if you have health insurance through your employer, you don’t need additional coverage. This isn't necessarily true. Many employer-sponsored plans have limitations, such as high deductibles or restricted networks. An article from Healthcare.gov explains that supplemental coverage can help fill gaps in your healthcare needs, ensuring that unexpected medical expenses don't lead to significant financial stress. Recognizing and debunking these myths can empower consumers to make informed decisions about their insurance needs.

How to Compare Insurance Policies: Tips for Finding the Best Fit

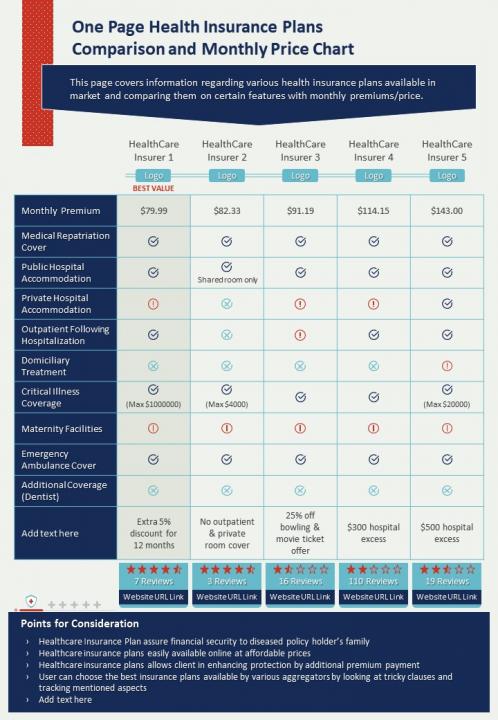

When it comes to comparing insurance policies, the first step is to identify your specific needs. Consider factors such as the type of coverage required, your budget, and any potential risks associated with your lifestyle or assets. It's essential to gather quotes from multiple providers, ensuring you have a baseline for comparison. Websites like Insure.com offer tools that allow you to compare quotes and coverage options side by side. Additionally, make a list of questions to ask potential insurance agents, such as about the claims process and any hidden fees.

Once you have a selection of policies on your radar, analyze the details closely. Look for differences in premiums, deductibles, and coverage limits. Consider using a spreadsheet to keep track of each policy's features and costs. Don't forget to read customer reviews and ratings on platforms like Nasdaq to gauge the experiences of other policyholders. By focusing on these factors, you can make an informed decision, ensuring that you choose an insurance policy that is the best fit for your circumstances.