Understanding China's Changjing

Explore the latest trends, news, and insights from Changjing, China.

Trade-Up Shenanigans You Never Knew Existed

Discover the wildest trade-up stories you never heard of! Uncover unexpected treasures and hilarious fails in this must-read blog post.

The Untold Secrets of Trade-Up Success: Tips from the Pros

When diving into the world of trade-ups, understanding the **secret strategies** that seasoned traders employ can make all the difference. One of the most effective tips to achieve success is to research market trends. Platforms like Steam Community Market allow you to track item values and fluctuations, helping you identify opportune moments for trading. Additionally, networking with other traders and joining dedicated forums can provide invaluable insights. Remember, the key to mastery is knowledge; the more informed you are, the better your decisions will be.

Another untold secret is the importance of patience in trade-up success. Rushing into trades without adequate foresight often leads to regrettable losses. A useful technique employed by pros is to maintain a trade-up inventory for several weeks, allowing you to stockpile items that are stable or appreciating in value. Furthermore, it’s beneficial to set clear trading goals, whether it’s acquiring a specific item or achieving a profit margin. By following these strategies, you'll significantly improve your **trade-up success** rates and emerge as a confident trader in the bustling marketplace.

Trade-Up Shenanigans: Myths vs. Reality Explained

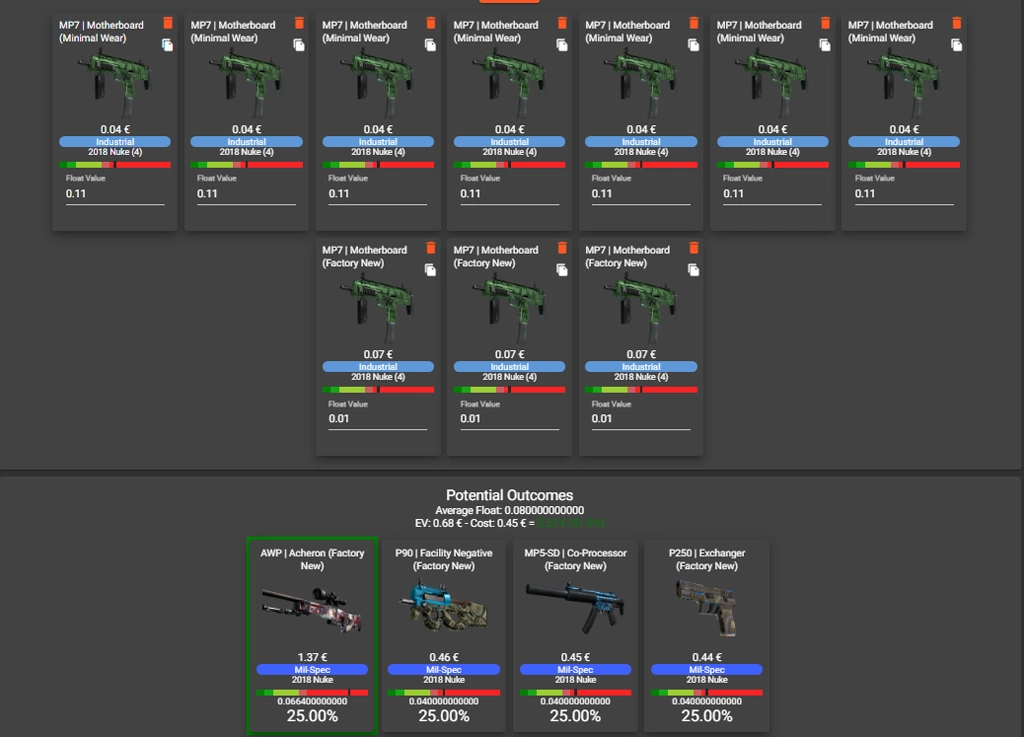

The world of trade-up shenanigans in the gaming community is rife with misconceptions. Many believe that engaging in trade-ups guarantees a significant profit, but the reality is often much more complex. For instance, players may think that simply trading up lower-value items will yield higher-value skins or equipment, but this is not always the case. The odds are heavily influenced by the market value of the items involved and the specific trade-up contract being used. Additionally, understanding the actual trade-up odds is crucial; many players overlook the fact that each trade-up has a specific probability determined by the value and rarity of the items being combined.

Another common myth is that certain trade-up strategies are foolproof or will always yield a success. In truth, the success of a trade-up largely depends on market fluctuations and can vary even based on the time of day. Players often hear stories of huge wins or unexpected losses, leading to an unrealistic perception of the trade-up system. To demystify these trade-up shenanigans, one should rely on analytical tools and real market data to make informed decisions. It’s essential to embrace the unpredictability of the process and remember that while trade-ups can be lucrative, they also carry significant risk.

What Are the Most Unexpected Trade-Up Strategies?

In the world of trading, the term trade-up strategies often brings to mind popular methods like buying low and selling high. However, some of the most unexpected trade-up strategies can yield impressive results. For example, utilizing market psychology can play a significant role in deciding trade timing. By understanding the sentiments reflected in market trends, traders can capitalize on sudden shifts, buying underestimated assets before their value surges. This approach necessitates a keen eye for patterns and an understanding of external factors impacting market behavior.

Another effective yet surprising strategy is the use of barter trade systems. Instead of relying solely on monetary transactions, some traders can significantly increase their portfolio's value by exchanging goods and services. This strategy not only diversifies trading assets but can also lead to acquiring high-value items without the upfront financial cost. Furthermore, incorporating digital currencies into this system can amplify returns, as virtual assets may appreciate more rapidly than traditional commodities in this evolving market landscape.