Understanding China's Changjing

Explore the latest trends, news, and insights from Changjing, China.

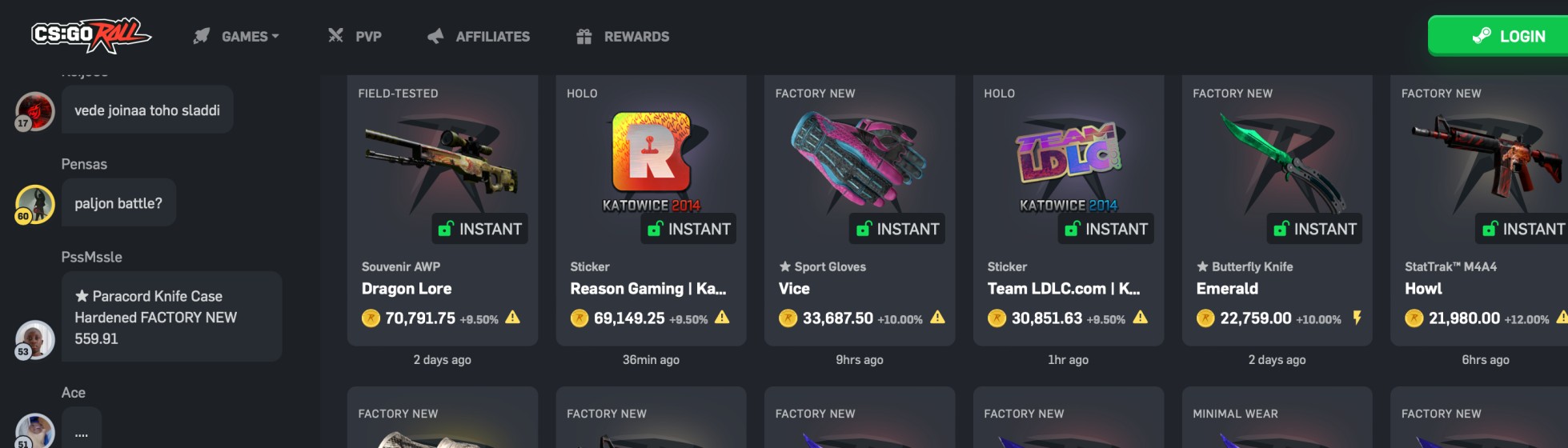

CS2 Trade Bots: The Secret Life of Digital Traders

Discover the hidden world of CS2 trade bots and how they’re revolutionizing digital trading. Uncover secrets and tips for success!

Understanding CS2 Trade Bots: How They Revolutionize Digital Trading

Understanding CS2 Trade Bots is essential for anyone looking to enhance their digital trading experience. These automated tools utilize algorithms to analyze market trends and execute trades based on pre-set conditions. By leveraging advanced data analytics, CS2 trade bots eliminate the emotional bias that often plagues manual trading, allowing users to capitalize on market fluctuations with precision. This innovative technology not only increases efficiency but also enables traders to operate around the clock, ensuring that no opportunities are missed.

Moreover, CS2 trade bots offer a variety of strategies tailored to individual trading preferences. Users can select from scalping, day trading, or swing trading tactics, depending on their financial goals and risk tolerance. Most importantly, these bots come equipped with backtesting features, allowing traders to evaluate historical performance before committing real funds. By understanding how these CS2 trade bots function, traders can significantly improve their strategies and navigate the ever-evolving landscape of digital finance more effectively.

Counter-Strike is a popular tactical first-person shooter game that emphasizes teamwork and strategy. Players can encounter various technical issues, such as when the cs2 mic not working, which can hinder communication during gameplay. The game has evolved through different versions, with each iteration bringing new maps, weapons, and gameplay mechanics that keep the community engaged.

The Benefits and Risks of Using CS2 Trade Bots in Your Trading Strategy

The integration of CS2 trade bots into trading strategies has gained popularity due to their potential to enhance efficiency and accuracy. One of the primary benefits of using these bots is their ability to execute trades at high speeds, far surpassing human capabilities. Additionally, they can analyze vast amounts of market data in real time, allowing traders to make informed decisions based on current trends. This automated approach not only saves time but also minimizes emotional trading, which can often lead to poor investment choices. In essence, CS2 trade bots can streamline the trading process and help investors capitalize on market opportunities more effectively.

However, it is crucial to consider the risks associated with employing CS2 trade bots as part of a trading strategy. One major risk is the reliance on algorithmic logic, which can fail to adapt to sudden market changes or unusual events. In addition, improper configuration or programming of these bots could lead to significant financial losses. Moreover, traders may become overly dependent on automated systems, neglecting the importance of personal market knowledge and intuition. Therefore, while CS2 trade bots can provide several advantages, it is essential for traders to remain vigilant and maintain a balanced approach when incorporating them into their strategy.

Common Questions About CS2 Trade Bots: What You Need to Know Before Investing

When considering investing in CS2 trade bots, it’s essential to understand how they function. These automated systems are designed to execute trades on your behalf, leveraging algorithms that analyze market trends and data to make informed decisions. One common question among investors is, 'How do I choose a reliable CS2 trade bot?' The answer lies in research; look for bots with positive user reviews, transparent performance metrics, and solid customer support. Additionally, ensure the bot is regularly updated to adapt to the evolving CS2 market.

Another critical aspect to consider is the cost associated with CS2 trade bots. Investors often ask, 'What are the typical fees or commissions?' Typically, these bots may charge a subscription fee, a percentage of profits, or both. It's crucial to read the fine print and understand the pricing structure before committing. Finally, remember to start small; test the waters with a limited budget to gauge the bot's effectiveness before making a larger investment.