Understanding China's Changjing

Explore the latest trends, news, and insights from Changjing, China.

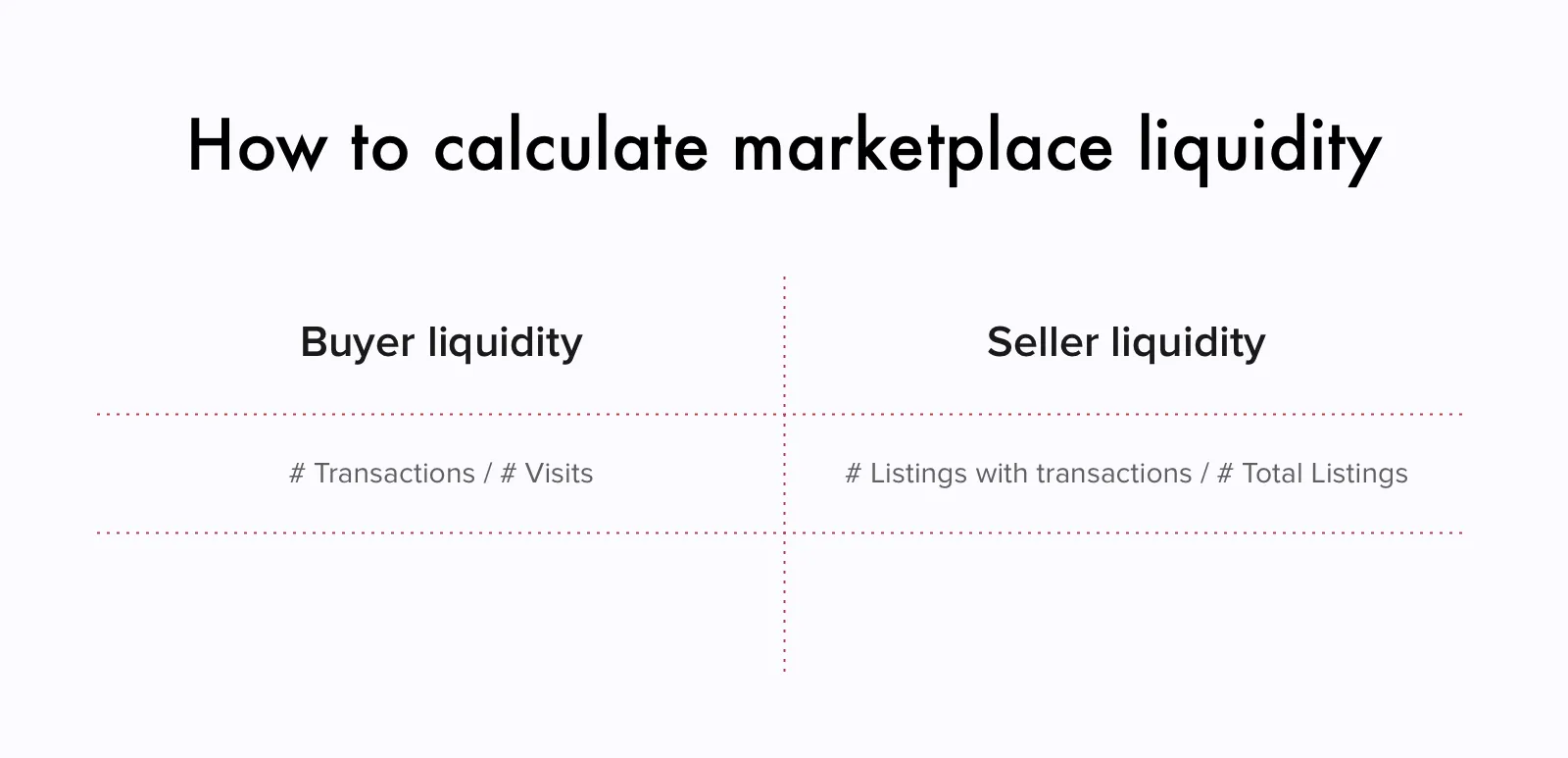

Marketplace Liquidity Models: Peeking Behind the Curtain of Trading Dynamics

Discover the secrets of marketplace liquidity models and uncover the trading dynamics that drive profits. Don't miss out on insider knowledge!

Understanding Market Depth: The Key to Liquidity in Trading

Understanding market depth is essential for traders looking to gain insights into the liquidity of financial instruments. Market depth refers to the market's ability to sustain relatively large market orders without impacting the price of the asset. A market with high depth indicates ample buy and sell orders at various price levels, which enhances the liquidity of that market. This liquidity is crucial for traders as it allows for smoother execution of trades and the ability to enter or exit positions without significant price slippage.

To better grasp the importance of market depth, consider the following key points:

- Liquidity: Greater market depth typically translates to higher liquidity, facilitating quicker transactions.

- Price Stability: A deeper market often leads to more stable prices, reducing the volatility seen in thin markets.

- Market Dynamics: Understanding the order book and where buy and sell orders are stacked provides insight into potential price movements.

Ultimately, mastering the concept of market depth equips traders with the knowledge needed to navigate the complexities of the trading environment effectively.

Counter-Strike is a popular tactical first-person shooter game that emphasizes teamwork and strategy. Players can engage in various game modes, often competing as two teams: terrorists and counter-terrorists. If you're looking to enhance your gaming experience, you might want to check out a daddyskins promo code for exclusive offers on in-game items.

Impact of Liquidity Models on Price Discovery: Insights for Traders

The impact of liquidity models on price discovery is profound, as these models shape how market participants interact with assets. In liquid markets, prices tend to reflect the true value of an asset more accurately due to the high volume of trades and the minimal impact of individual transactions. Conversely, in less liquid markets, prices can be significantly influenced by a few large trades, leading to volatility and inefficiencies in price discovery. Traders must understand the prevailing liquidity conditions and the relevant models, such as the order book model and market maker model, to make informed decisions.

For traders, insights into liquidity models are essential for optimizing trading strategies and managing risk. Effective liquidity management can enhance trade execution and improve profitability. For instance, traders who utilize dynamic liquidity models can anticipate price movements and adjust their strategies accordingly. Furthermore, the use of algorithms that incorporate liquidity metrics allows for more precise entry and exit points, thereby capitalizing on market inefficiencies. In summary, understanding the relationship between liquidity models and price discovery empowers traders to navigate the complexities of the market more effectively.

What Factors Influence Marketplace Liquidity Dynamics?

Marketplace liquidity dynamics are influenced by various factors that impact how quickly assets can be bought or sold without causing significant price changes. One of the primary factors is the trading volume, which refers to the number of transactions occurring within a specific timeframe. High trading volume typically indicates a more liquid market, as it allows buyers and sellers to transact more easily. Additionally, the number of market participants plays a crucial role; when more buyers and sellers are involved, it increases competition and narrows the spread between bid and ask prices, further enhancing liquidity.

Another key factor affecting marketplace liquidity dynamics is the market structure. Different market types, such as order book markets versus quote-driven markets, can exhibit varying levels of liquidity. For example, decentralized marketplaces may struggle with liquidity due to lower participation rates compared to established centralized exchanges. Furthermore, external factors including regulatory changes and economic conditions can also impact liquidity; during periods of uncertainty, traders may be more reluctant to enter the market, leading to reduced liquidity levels.